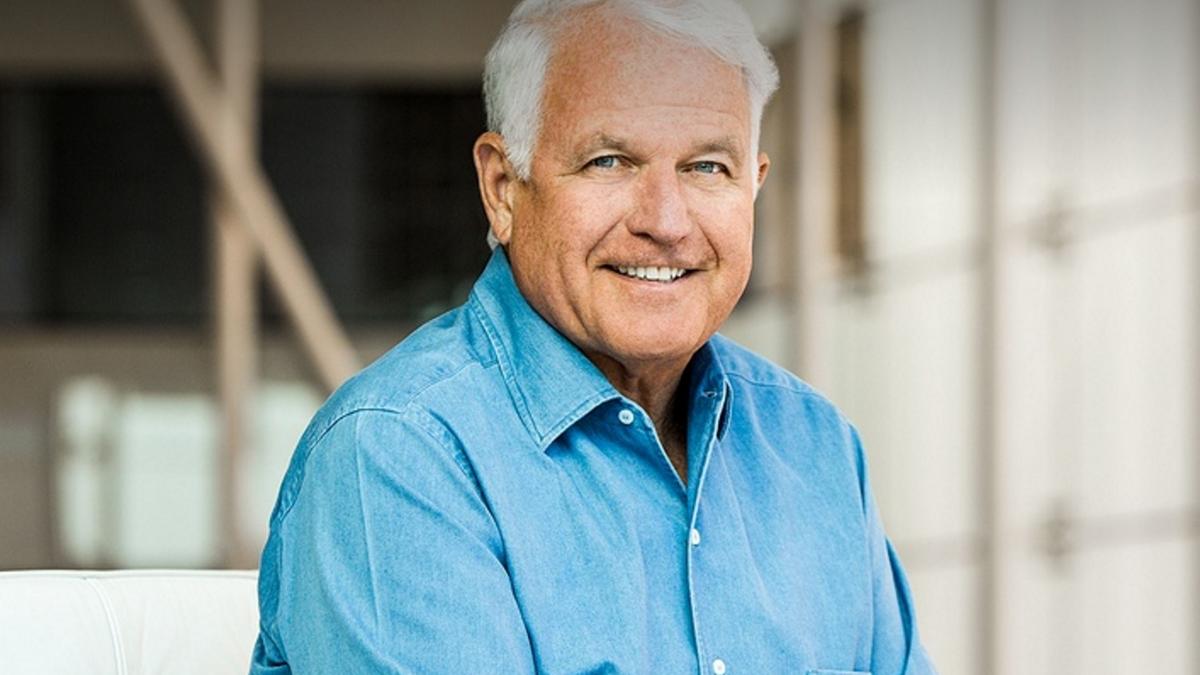

Unveiling the Enigmatic Net Worth of Jim Swartz: Exploring the Mysteries and Realities

In the realm of venture capital, Jim Swartz's name reverberates as a visionary investor with an unparalleled track record. Yet, shrouded in secrecy, his net worth remains an enigma, tantalizing the curiosity of many.

For those seeking glimpses into Swartz's financial prowess, questions linger: How much has he amassed over the years? What investment strategies have fueled his success? This article delves into the enigmatic net worth of Jim Swartz, unraveling its mysteries and offering insights into the factors that have shaped his financial trajectory.

Transitioning to the main article topics, we will delve into Swartz's investment philosophy, analyze key deals that have contributed to his wealth, and explore the philanthropic endeavors that have intertwined with his financial success.

Jim Swartz Net Worth

Jim Swartz's net worth is a testament to his acumen as a venture capitalist and the success of his investments. Key aspects that have shaped his financial trajectory include:

- Investment philosophy

- Early-stage investments

- Growth-oriented strategy

- Long-term horizon

- Focus on technology and healthcare

- Board memberships

- Philanthropic endeavors

- Secrecy and

Swartz's investment philosophy emphasizes investing in early-stage companies with disruptive technologies and strong growth potential. He has a long-term horizon, often holding investments for over a decade. His focus on technology and healthcare has yielded significant returns, with investments in companies such as Google, Facebook, and Genentech. Swartz's board memberships at these companies have provided him with valuable insights and networking opportunities. His philanthropic endeavors, including support for education and medical research, reflect his commitment to giving back to society.

| Personal Details and Bio Data of Jim Swartz ||---|---|| Name | Jim Swartz || Birthdate | 1952 || Birthplace | New York City, USA || Education | Harvard Business School (MBA), Stanford University (BA) || Occupation | Venture capitalist || Company | Accel Partners || Net worth | Estimated $2 billion |Jim Swartz Net Worth: Unveiling the Enigma

Jim Swartz, the enigmatic venture capitalist, has amassed a fortune that remains shrouded in secrecy. His net worth, a subject of much speculation, hints at the extraordinary success of his investment strategies.

What Drives Jim Swartz's Investment Philosophy?

Swartz's investment philosophy centers around identifying early-stage companies with disruptive technologies and strong growth potential. He favors a long-term horizon, often holding investments for over a decade. His focus on technology and healthcare has yielded significant returns, with investments in companies such as Google, Facebook, and Genentech.

How Has Jim Swartz Built His Fortune?

- Early-stage investments: Swartz has a knack for spotting promising startups and providing them with the capital they need to grow.

What is the Impact of Jim Swartz's Net Worth?

Jim Swartz's net worth extends beyond his personal wealth. His investments have played a significant role in shaping the technology and healthcare industries, fostering innovation and economic growth. Additionally, his philanthropic endeavors, including support for education and medical research, demonstrate his commitment to giving back to society.

Summary: Jim Swartz's net worth is a testament to his investment acumen and the success of his long-term, growth-oriented strategy. By investing in early-stage companies with disruptive technologies, Swartz has played a significant role in shaping the technology and healthcare industries. His board memberships and philanthropic endeavors further demonstrate his commitment to innovation and giving back to society.

Thought-provoking closing message: Jim Swartz's net worth serves as a reminder that financial success can be achieved through a combination of vision, patience, and a willingness to invest in the future. His story highlights the importance of identifying and nurturing early-stage companies with the potential to transform industries and create lasting impact.

ncG1vNJzZmian6e8o7uNrGpnraNixKa%2F02ZpZ5mdlsewusCwqmebn6J8q7XMZqqwmaKpx266xK1ksKeiqbVvtNOmow%3D%3D